The data-focused market performance report on identifiers 6907485878, 5625688515, 965063068, 8449351745, 570550172, and 61203522 reveals critical dynamics within consumer behavior and market fluctuations. Through a meticulous analysis, significant trends emerge, indicating shifts in competitive landscapes and preferences. The implications for investment strategies are profound, yet they also underscore the necessity for adaptability in navigating future uncertainties. What specific strategies can stakeholders employ to leverage these insights effectively?

Overview of Key Identifiers

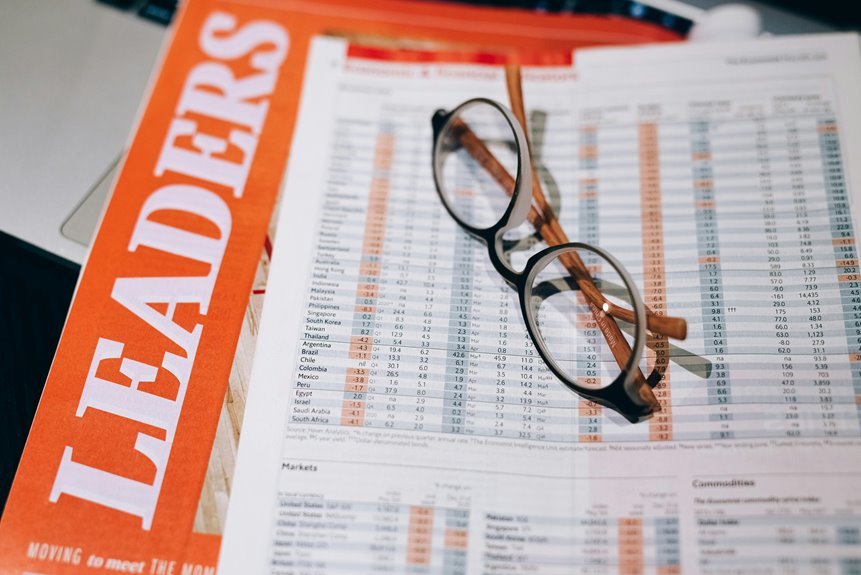

The landscape of market performance is often illuminated by key identifiers that serve as benchmarks for assessing economic health.

Key identifiers, such as GDP growth rates and unemployment figures, provide critical insights into market dynamics.

Through rigorous data analysis, these metrics reveal trends and patterns, enabling stakeholders to make informed decisions.

Understanding these identifiers is essential for navigating the complexities of the economic landscape.

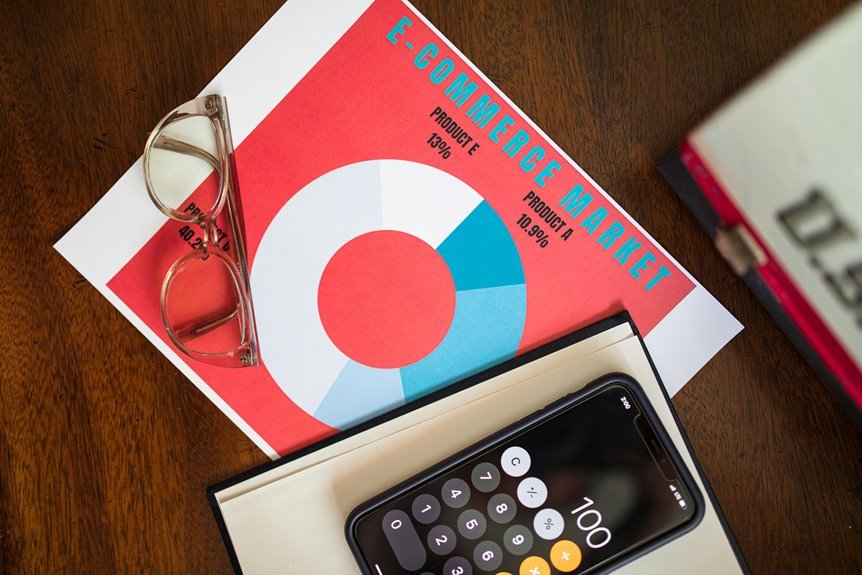

Market Trends and Insights

Market trends and insights emerge as vital components in the evaluation of economic performance, building upon the foundation established by key identifiers.

Understanding consumer behavior through market segmentation allows businesses to refine pricing strategies and enhance brand positioning.

Competitive analysis, informed by economic indicators, reveals shifts that influence market dynamics, ultimately shaping strategic decisions in response to evolving consumer preferences and competitive landscapes.

Investment Implications

As investors navigate the complexities of the current economic landscape, the implications of market performance take on heightened significance.

Effective investment strategies must incorporate thorough risk assessment to mitigate the effects of market volatility.

Additionally, prioritizing portfolio diversification remains essential in safeguarding against potential downturns, ensuring that investors can adapt to shifting market conditions and maintain their financial autonomy.

Future Projections and Strategies

Navigating the complexities of investment requires looking ahead to anticipate market trends and develop effective strategies.

Future forecasts indicate a shift towards sustainable investments and technology-driven sectors.

Strategic planning must incorporate adaptability and risk assessment to capitalize on emerging opportunities.

Investors are encouraged to remain vigilant and responsive to market changes, ensuring their portfolios align with evolving economic landscapes and personal financial goals.

Conclusion

In the intricate tapestry of market dynamics, the identifiers serve as threads weaving together consumer behavior and investment strategies. As stakeholders navigate this evolving landscape, the report underscores adaptability as a compass guiding informed decisions. Just as a ship must adjust its sails to harness shifting winds, investors must embrace agility to capitalize on emerging trends. Ultimately, the insights gleaned from this analysis illuminate pathways for sustainable growth, reinforcing the notion that foresight in volatility can yield fruitful returns.